main street small business tax credit ca

Each employer is limited to no more than 100000 of this credit. Welcome to the California.

California Main Street Small Business Credit Ii Kbkg

State for zero emission vehicles which also includes hydrogen fuel cell and plug-in hybrid-electric vehicles and accounts for 18 of new car sales.

. Created Main Street Hiring Tax Credit. How to claim File your original or amended income tax return. Include your Main Street Small Business Hiring Credit FTB.

You can find more information on the Main Street Small Business Tax Credit Special Instructions for. How to Claim File your income tax return. Governor Newsom signed SB 1447 Bradford Caballero and Cervantes authorizing a 100 million hiring tax credit program for.

Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the. The California government announced Main Street Small Business Tax Credit II on November 1 2021 to offer further financial aid to small businesses struggling to make. Beginning on Monday November 1 California Businesses that meet certain qualifying criteria can claim their portion of the 70 million allocated via AB150 to reward.

Each employer is limited to no more than 150000 in credit. 2021 Main Street Small Business Tax Credit II Reservation System The 2021 Main Street Small Business Tax Credit II reservation process is now closed. Employers that had fewer than 500 employees on.

4 hours agoCalifornia is the biggest US. Taxpayers that qualified for Employee Retention Credit may also qualify for the Main Street Small Business Tax Credit. A qualified small business tax credit employer is the one who files an original tax return to get the Main Street Small Business tax credit instead of an amended one.

The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax. The amount of credit you may receive for the 2021 taxable year. For more information on computing the credit visit CDTFAcagov.

Each employer is limited to no more than 100000 of this credit. The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. Each employer is limited to no more than 150000 in credit.

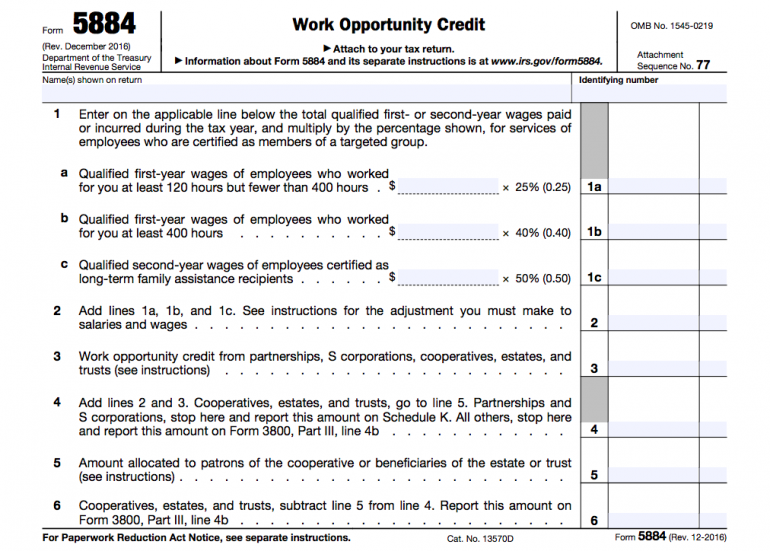

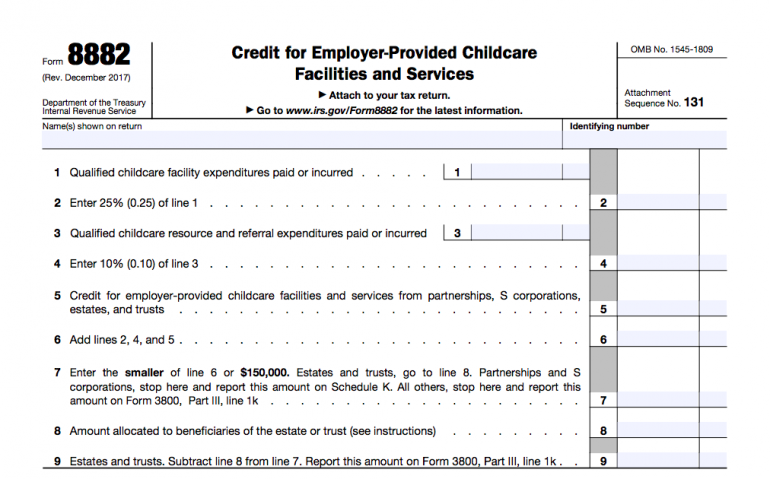

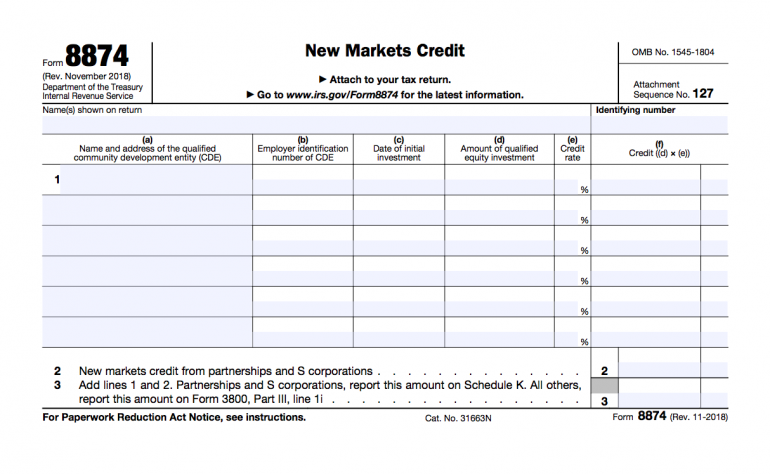

Small Business Tax Credits The Complete Guide Nerdwallet

Small Business Tax Credits The Complete Guide Nerdwallet

Can You Pay Taxes With Your Credit Card Nextadvisor With Time

California Small Business Hiring Tax Credit State And Local Taxes Holthouse Carlin Van Trigt Llp

The Main Street Small Business Tax Credit For Small Businesses Launched Last Week Get Started And Learn More At Taxcredit Cdtfa Ca Gov By State Of California Franchise Tax Board Facebook

2021 Main Street Small Business Tax Credit In California Heather

News Flash Modesto Ca Civicengage

2021 Main Street Small Business Tax Credit In California Heather

Small Business Tax Credits The Complete Guide Nerdwallet

First Come First Served By November 30 California Hiring Tax Credit Ii Windes

Your Small Business Tax Questions Answered The Ups Store Canada

Small Business Association Advocate For Owners Nfib

California Main Street Small Business Credit Ii Kbkg

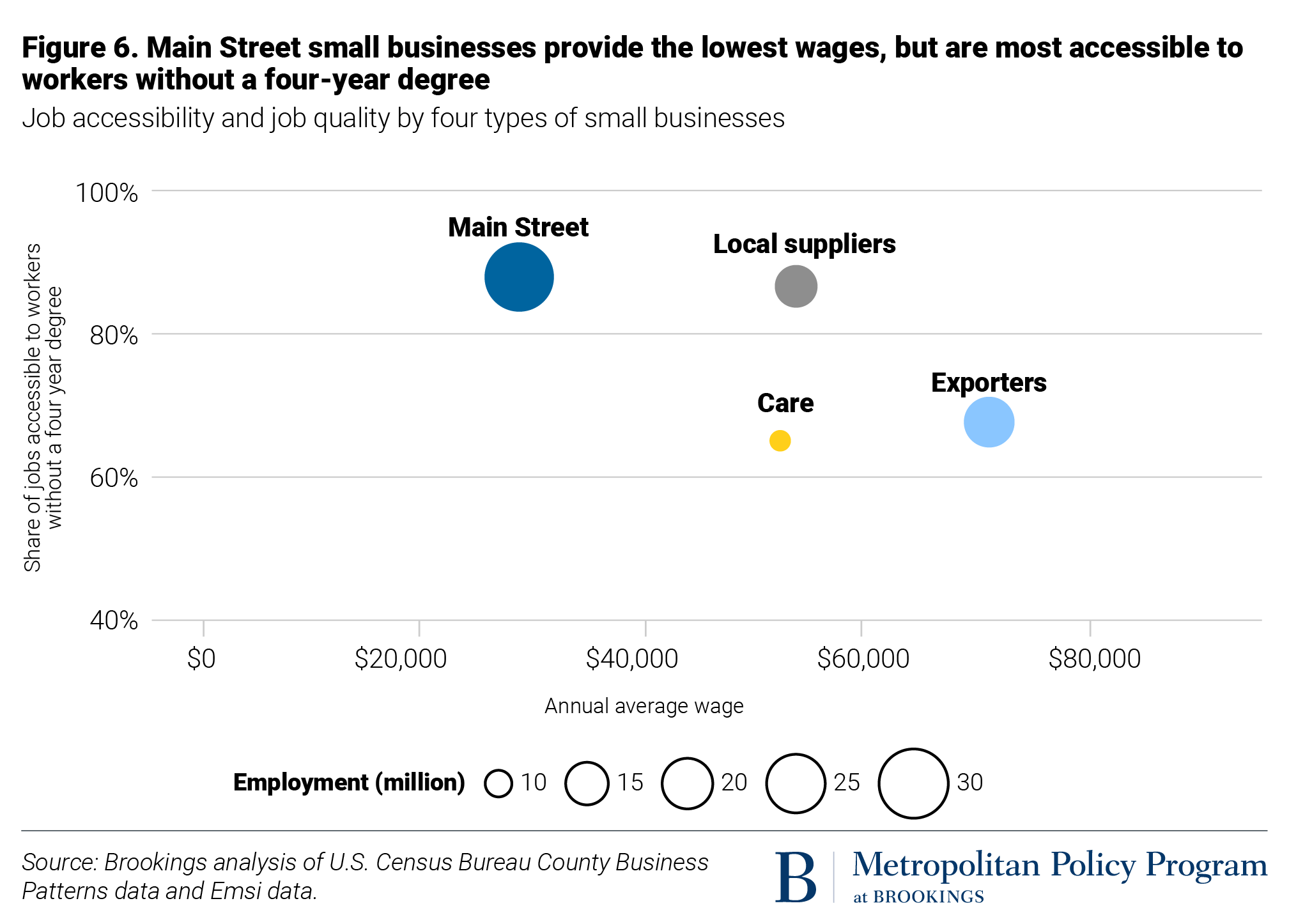

From Relief To Recovery Using Federal Funds To Spur A Small Business Rebound Stage 2 Recovery

State Tax Credit And Incentives Update Marcum Llp Accountants And Advisors